retroactive capital gains tax increase

TKO Taseko or the Company reports Adjusted EBITDA of 201 million for the full-year 2021 an 85 increase over 2020. The reduction in the capital gains tax from 20 percent to 15 percent saves Mr.

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Jones 50000 this year and saves Mr.

. Earlier in 2021 there were proposals to either end the step-up in basis or reduce the amount of inherited assets that. And the new tax will not be retroactive. It has both microeconomic and macroeconomic aspects.

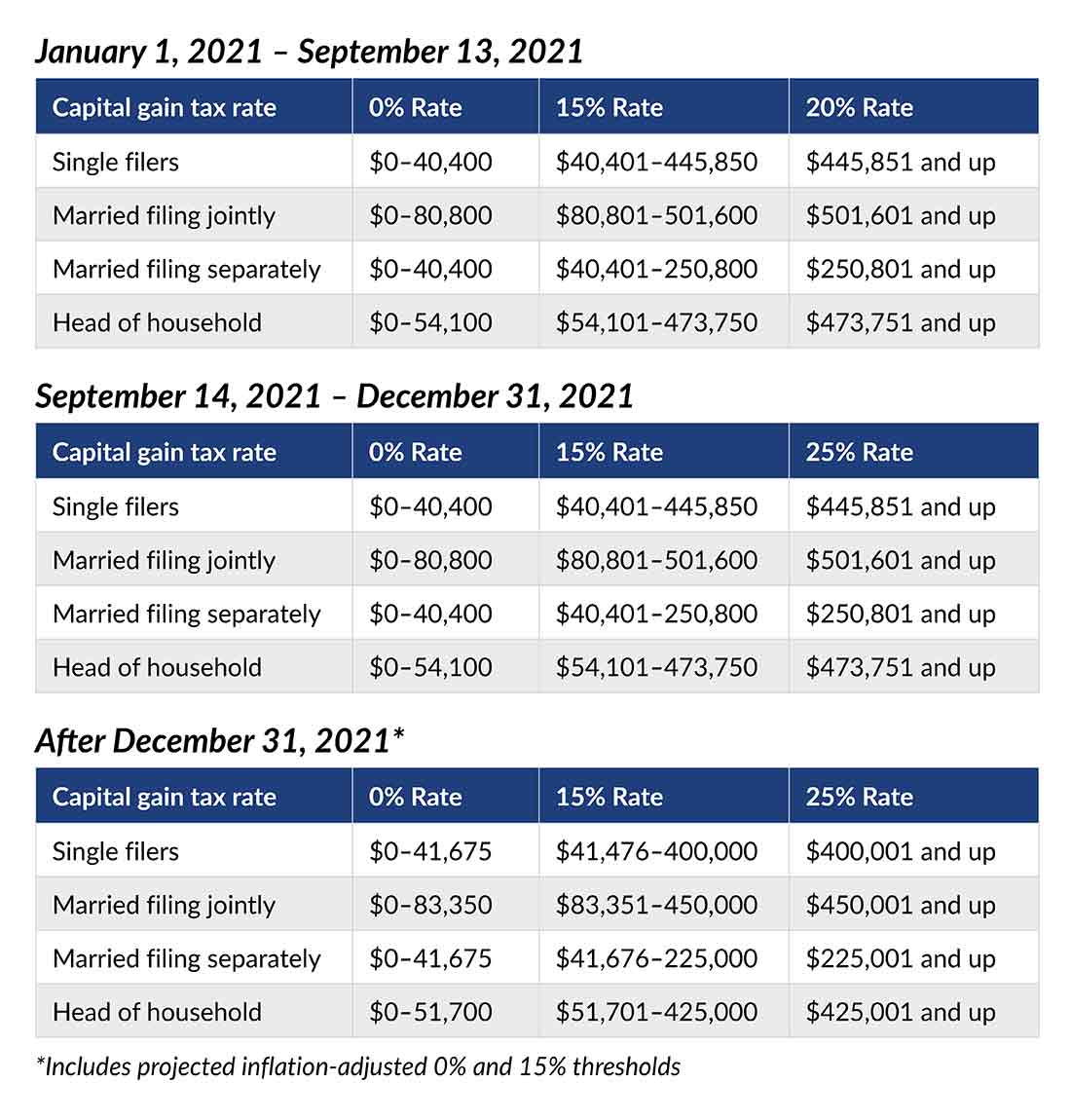

Was extended through 2010 as a result of the Tax Increase Prevention and Reconciliation Act signed into law by President Bush on 17 May 2006 which also reduced the 5 rate to 0. Change from excluded position. The proposed increase in capital gain rates to ordinary income is retroactive to April 28 2021 possibly 052821 if we use the date of the Green Book.

The Convention also introduces several changes necessary to accommodate important aspects of the Tax Reform Act of 1986. This is one component of fiscal policyThe microeconomic aspects concern issues of fairness. 2020-2021 Capital gains tax brackets Not all income is taxed according to the marginal tax brackets and capital gains income from when you sell an investment or asset for a profit are the big.

Thirteen states have notable tax changes taking effect on July 1 2021 which is the first day of fiscal year FY 2022 for every state except Alabama Michigan New York and Texas. This withholding reduction will also increase the attractiveness of investment in the United States for German multinationals. A capital gains tax CGT.

Increase Enrollment 1a From Self Only to Self and Family From One Plan or Option to Another Cancel or Decrease Enrollment 1b Participate Waive When a Health Benefits Election Form Must be Filed With the Employing Office. Explore the latest 2021 state tax changes including 2021 state tax changes that take effect on July 1 2021 and are retroactive to January 1 2021. Taseko Mines Limited TSX.

As of January 1 2021 Proposition EE increased the cigarette tax from 084 to 194 per pack set a minimum after-tax retail price for cigarettes at 700 per pack increased the tax on other tobacco products from 40 percent to 50 percent of wholesale value created a new tax on nicotine products at 30 percent of wholesale value and established a policy by which. German integrated tax system in 1977. These include principally provision for the imposition of.

The macroeconomic aspects concern the overall quantity of taxes to collect which can inversely affect the level of economic activity. - The provisions of Section 39B notwithstanding a final tax of six percent 6 based on the gross selling price or current fair market value as determined in accordance with Section 6E of this Code whichever is higher is hereby imposed upon capital gains presumed to have been realized from the sale exchange or other disposition of real property located in the Philippines. The original House bill proposed a new top rate on capital gains and dividends of 25 for individuals with more than 400000 in income but the proposal was dropped from the version passed by the House.

Temporary employee who completes 1 year of service and is. Initial opportunity to enroll for example. Tax policy is the choice by a government as to what taxes to levy in what amounts and on whom.

Toward the end of 2010 President Obama signed a law extending the reduced rate on eligible dividends until the end of.

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

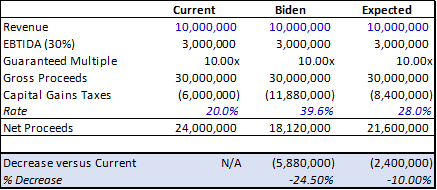

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

What Can The Wealthy Do About Biden S Proposed Tax Increases

Historical Past And Retroactive Capital Gains Rate Modifications T3elearning

A Retroactive Tax Increase Wsj

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran